Hydrogen patents shift towards clean technologies with Europe and Japan in the lead

- Latest EPO-IEA report is the most comprehensive and up-to-date study of global trends in hydrogen technologies for 2011-2020

- Hydrogen production technology patents have massively shifted towards alternative, low-emissions methods such as electrolysis

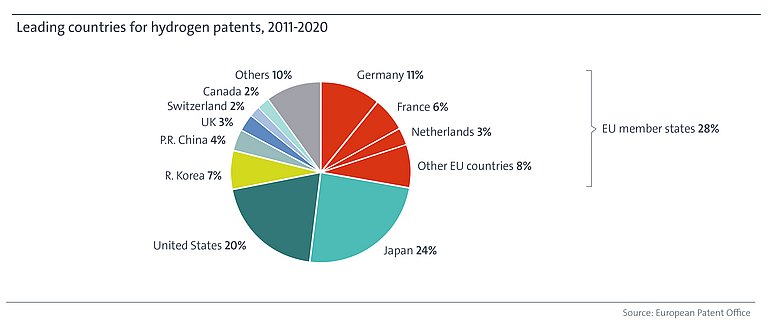

- Patenting related to hydrogen is led by EU (28%) and Japan (24%), while US (20%) is only major innovation centre to lose ground in past decade

- Germany (11%), France (6%) and Netherlands (3%) rank first in Europe for patenting hydrogen technologies, and Europe is gaining an edge in electrolyser manufacturing capacity

- Among end-use applications, automotive continues to be the biggest focus of innovators; other applications, such as long-distance transport, power generation and heavy industry, need to ramp up

- Start-ups holding patents attracted more than half of the USD10 billion in venture capital investment into hydrogen-related firms in the last decade

Munich, 10 January 2023 – Innovation in hydrogen is shifting towards low-emission solutions, with Europe and Japan in the lead and the United States losing ground, according to a new joint study of hydrogen technology patents by the European Patent Office (EPO) and the International Energy Agency (IEA).

The report uses global patent data to provide a comprehensive, up-to-date analysis of innovation in hydrogen technologies. It is the first study of its kind and covers the full range of technologies, from hydrogen supply to storage, distribution and transformation, as well as end-use applications.

“Harnessing the potential of hydrogen is a key part of Europe’s strategy to achieve climate neutrality by 2050,” said EPO President António Campinos. “But if hydrogen is to play a major role in reducing CO2 emissions, innovation is urgently needed across a range of technologies. This report reveals some encouraging transition patterns across countries and industry sectors, including Europe’s major contribution to the emergence of new hydrogen technologies. It also highlights the contribution of start-ups to hydrogen innovation, and their reliance on patents to bring their inventions to market.”

“Hydrogen from low-emissions sources can play an important role in clean energy transitions with potential to replace fossil fuels in industries where few clean alternatives exist, like long-haul transport and fertilizer production,” said IEA Executive Director Fatih Birol. “This study shows that innovators are responding to the need for competitive hydrogen supply chains, but also identifies areas – particularly among end-users – where more effort is required. We will continue to help governments spur innovation for secure, resilient and sustainable clean energy technologies.”

Europe and Japan ahead

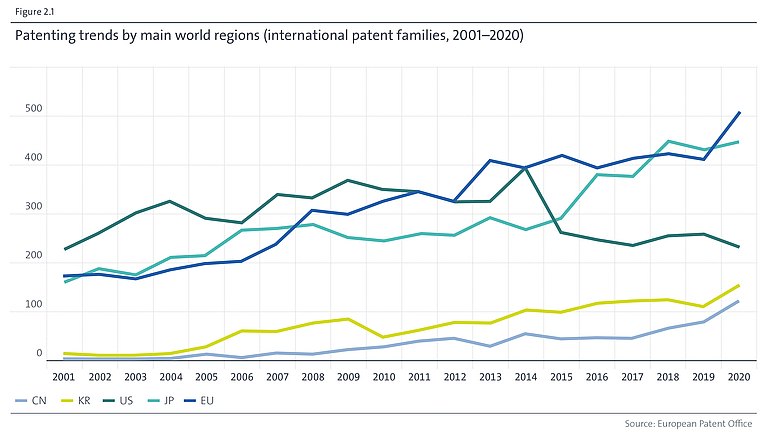

The study presents the major trends in hydrogen technologies from 2011 to 2020, measured in terms of international patent families (IPFs), each of which represents a high-value invention for which patent applications have been filed at two or more patent offices worldwide. The report finds that global patenting in hydrogen is led by the EU and Japan, who account for 28% and 24% respectively of all IPFs filed in this period. Both regions also saw significant growth in the past decade. The leading countries in Europe are Germany (11% of the global total), France (6%), and the Netherlands (3%). By contrast, the US, with 20% of all hydrogen-related patents, is the only major innovation centre to see international hydrogen patent applications decline in the past decade. International patenting activity in hydrogen technologies remained modest in South Korea and China but is on the rise. In addition to these five main innovation centres, other countries generating significant volumes of hydrogen patents include the UK, Switzerland and Canada.

Innovation responds to the need to tackle climate change

Hydrogen production technologies accounted for the largest number of hydrogen patents overall in the 2011-2020 period, and the report finds that across all segments of the hydrogen value chain, low-emission innovations generated more than twice the number of international patents than established technologies. While hydrogen production is currently almost entirely fossil-based, the patenting data shows a massive shift towards alternative, low-emissions methods such as electrolysis. Technologies motivated by climate concerns accounted for nearly 80% of all hydrogen-production related patents in 2020, with growth driven chiefly by a sharp increase of innovation in electrolysis. The most innovative regions are now competing to host the first phase of industrial roll out, with the data suggesting that Europe is gaining an edge as a location for investment in new electrolyser manufacturing capacity.

Among hydrogen’s many potential end-use applications, the automotive sector has long been the focus for innovation, and patenting in this sector continues to grow, led mainly by Japan. The same momentum is not yet visible in other end-use applications, despite concerted policy and media attention in recent years on hydrogen’s potential to decarbonise long-distance transport, aviation, power generation and heating. This raises concern about countries’ net zero emission pledges, which cannot be achieved without addressing unabated fossil fuel use in these sectors. One bright spot relates to the use of hydrogen to decarbonise steel production, for which a recent uptick in patenting is visible – possibly in response to the post-Paris Agreement consensus that the sector needs radical solutions to cut emissions quickly – and this will hopefully be sustained in coming years.

Chemical and automotive companies file most hydrogen patents

Innovation in established hydrogen technologies is dominated by the European chemical industry, according to our ranking of top patent applicants. The legacy of expertise in this sector has also given it a head start in climate-motivated technologies such as electrolysis and fuel cells. Automotive companies are also active, and not just in vehicle technology. Behind them, universities and public research institutes generated 13% of all hydrogen-related international patents in 2011-2020, with French and Korean institutions topping the ranking, and with a focus on low-emissions hydrogen production methods such as electrolysis.

Hydrogen start-ups with patents attract finance

The study also finds that more than half of the USD 10 billion of venture capital investment into hydrogen firms in 2011-2020 went to start-ups with patents, despite them making up less than a third of the start-ups in our dataset. Holding a patent is a good indicator of whether a start-up will keep attracting finance: more than 80% of late-stage investment in hydrogen start-ups in 2011-2020 has gone to companies that had already filed a patent application in areas such as electrolysis, fuel cells, or low-emissions methods for producing hydrogen from gas.

Header: erika8213_AdobeStock.com

This is an original press release from the European Patent Office dated 10.01.2023

![[Translate to Englisch:] [Translate to Englisch:]](/fileadmin/_processed_/b/8/csm_Wasserstoffpatente_Header_breiter_b6d21bf7e6.jpg)